Haji Kamal Al-Rahman has immersed himself in the realms of business and entrepreneurship since his graduation from university in 1987 until 2022. His focal areas of expertise encompass accounting and taxation for small and medium enterprises (SMEs), financial management of SMEs, company secretarial duties, and conducting business training and entrepreneurship programs.

With over 35 years of hands-on experience, he has served a diverse clientele, catering to more than 1,500 sole proprietorships and over 200 small to medium-sized sole proprietorships and partnerships.

Beginning his educational journey in Parit, Perak for secondary education, he pursued further studies at UPM in 1980, enrolling in the Diploma in Agriculture program. Subsequently, he earned a Bachelor of Science (Resource Economics) from UPM in 1987. Additionally, Haji Kamal holds an Advanced Certificate in Taxation from the National Taxation Academy. His academic pursuits continued with a Master of Economics (Financial Economics) from UPM in 2000 and a Master of Business Law from UKM in 2008.

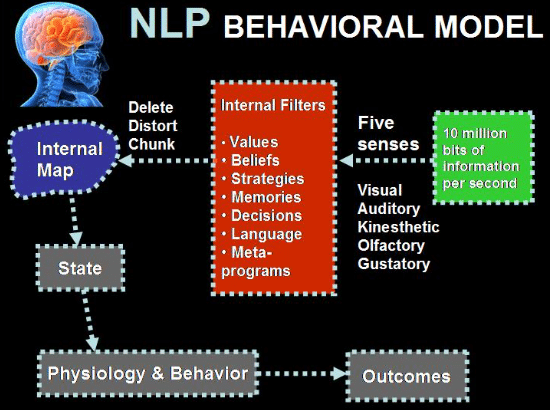

He has also contributed as a part-time lecturer/tutor, specializing in entrepreneurship at UPM and business economics at USIM. In 2020, Haji Kamal underwent the Train of Trainers (TOT) training under the HRDF certification scheme, achieving recognition as a Certified HRDF Trainer. He has further honed his skills through various NLP certification programs, including:

– Certified Basic NLP Practitioner (October, 2021)

– Certified NLP Coach (January, 2022)

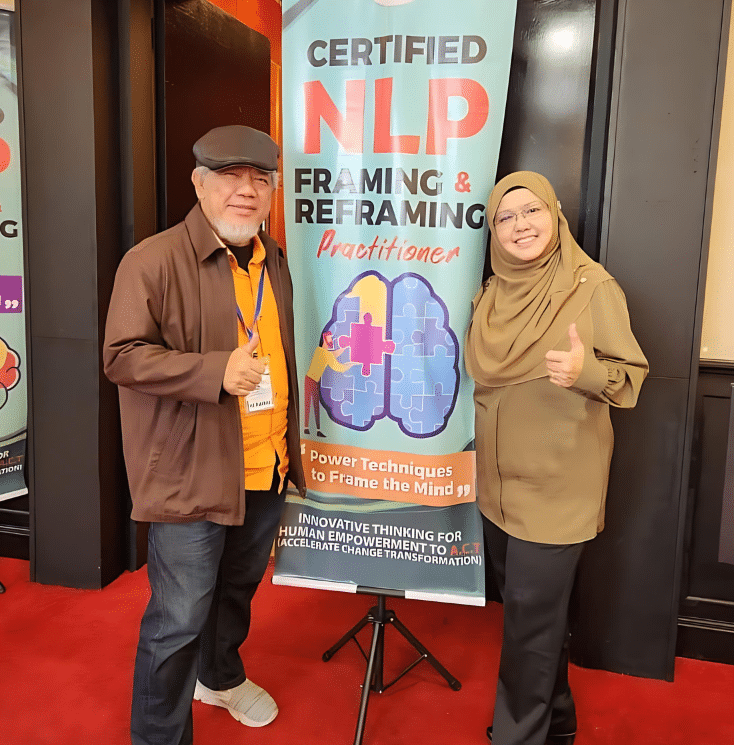

– Certified NLP Framing and Reframing Practitioner (March, 2023)

– Certified LAB Profile Practitioner (July, 2023)

– Certified NLP for Teachers Practitioners (Disember, 2023)

Haji Kamal holds an Associate Membership with the Certified Tax Institute of Malaysia (CTIM) and is a former Certified Tax Agent. He is also a Licensed Secretary under SSM and a Member of the Malaysian NLP Association.

As an author, Haji Kamal has penned several books, some of which have been published by DBP, including:

- Panduan Percukaian Untuk Industri Kecil dan Sederhana (1992)

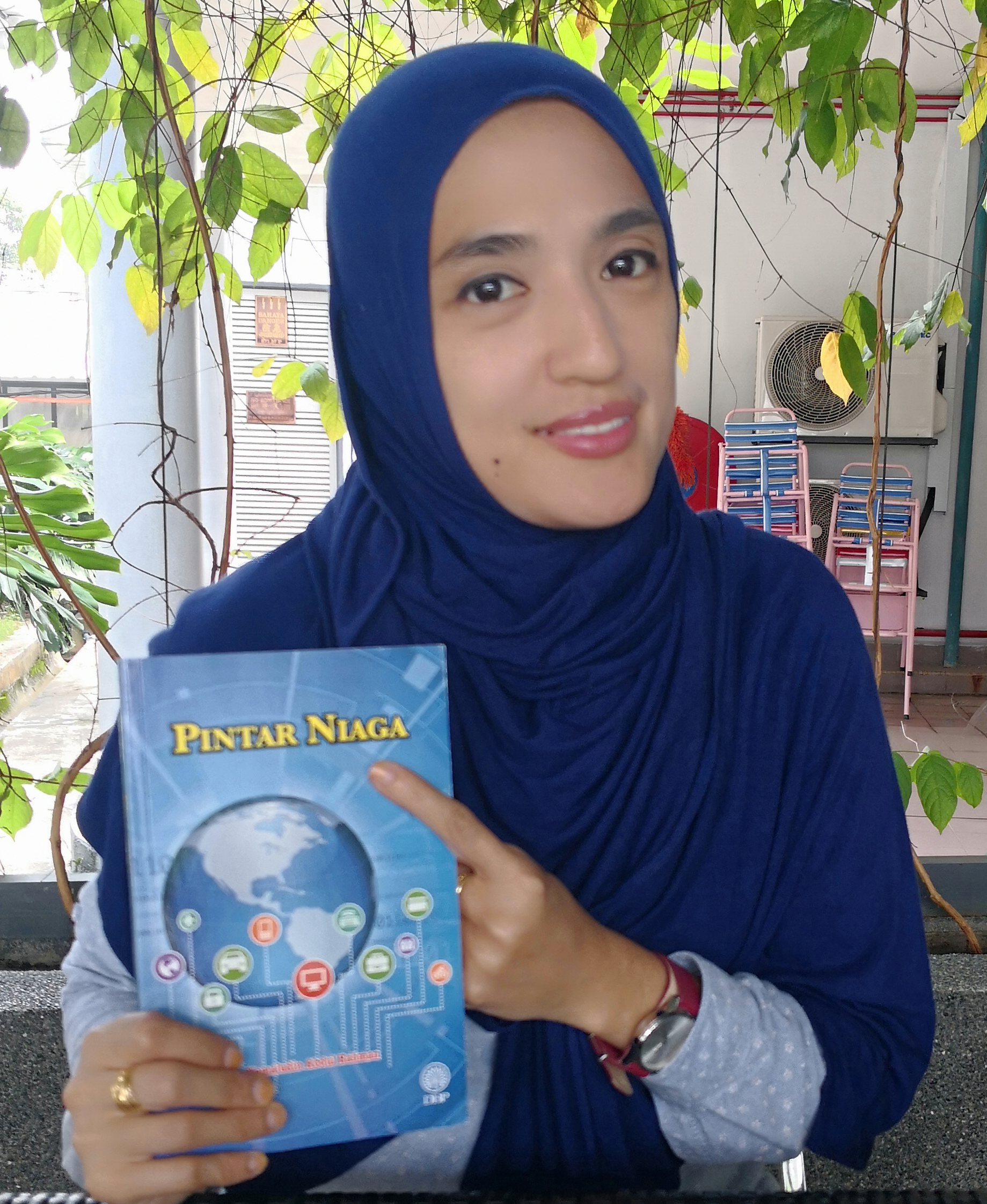

- Pintar Niaga (2015)

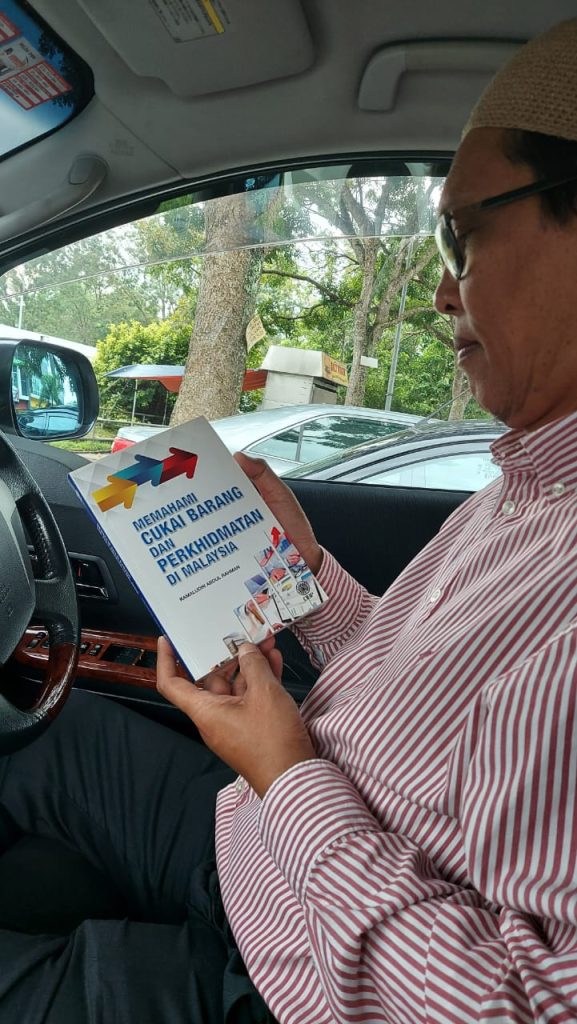

- Cukai Barang dan Perkhidmatan Di Malaysia (2018)

He has also authored the following E-Books:

- Budaya Kejayaan: Membingkai Semula Kegagalan

- Entiti Perniagaan: Milikan Tunggal, Perkongsian dan PLT.

- Memahami Syarikat Sendirian Berhad.

Currently, he is engaged in his home-based enterprise, focusing on authoring and promoting his own E-Books. Furthermore, he participates in affiliate marketing for Personal Collection products. Haji Kamal maintains an active presence in the blogosphere, discussing business and entrepreneurship topics on maskama.com. He holds a keen interest in Warren Buffet’s philosophy, advocating for involvement in businesses that generate income while we are sleeping.